Table of Content

If your loan requires an escrow account, you may not be able to cancel it. You can reference more information and forms for escrow accounts below. If you’re ending the fixed loan term before it has been completed you’ll need to pay what is known as a break cost. This is calculated in relation to your loan size, interest rate change, and how long was left on the fixed term.

However, you may not redraw an amount if it would result in the balance owing on your loan account exceeding the amount which would be owing if you had paid all scheduled repayments on time. For loans insured by the Federal Housing Administration , mortgage insurance is required on all loans, regardless of the down payment amount. You cannot file a claim against the policy, and generally cannot cancel it. More information on FHA Mortgage Insurance can be found in our guide download below. Whether you are looking to switch from another lender or want more affordable rates on your NAB home loan, they can help.

Refinance After A Repayment Holiday

This is because, banks want to stop people re-borrowing more than they can reasonably pay back within the original loan term. Following the backlash, they’ve decided to change back home loan redraw limits for any customers who wants it. Any excess funds that you’ve put in your home loan is essentially earning you the same rate charged on your home loan.

You can check the property price cap for your area on NHFIC’s website, opens in a new window. To apply to the scheme, your customer will be subject to the following eligibility criteria. They’ll need to be able to provide documentation of their eligibility to secure their position. Funds will be available the next business day from when we receive the completed contract via email.

Mortgage Insurance

It’s important to remember that the interest part of your repayments will increase because you’re now paying interest on a higher loan amount. Assessment of the advantages and disadvantages of choosing a fixed or variable rate. Access to a large number of lenders, interest rates and loan packages for you to choose from.

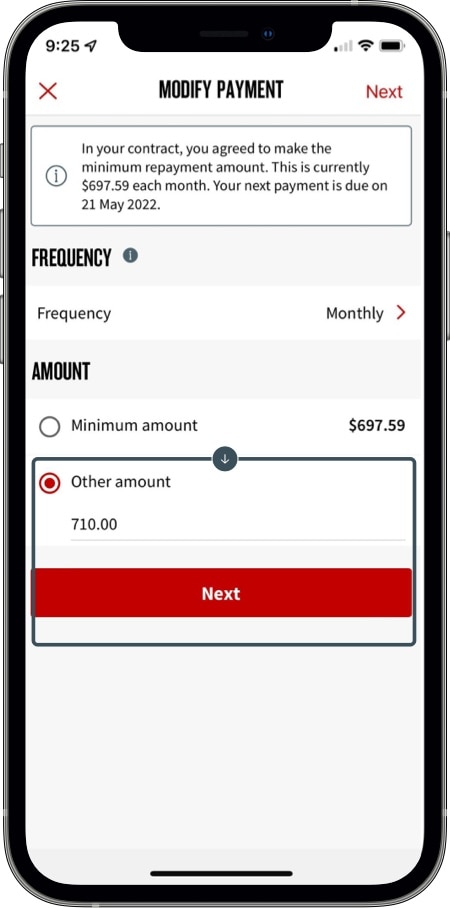

Rates and information current as at 16 December 2022 and are subject to change at any time. NAB Tailored Home Loan fees, charges, terms and conditions are available on request.NAB Choice Package fees, charges, terms and conditions, opens in a new window. Choice Package discounts and benefits only apply whilst your loan is part of a NAB Choice Package. The available redraw balance will not include repayments made towards your next monthly minimum repayment or uncleared cheques, and may have been adjusted on your monthly repayment date. Redraw is available on mostCommBank variable rate home loans, and there are no fees to redraw. For whatever reasons, lenders may decide not to allow you to redraw any repayments you’ve made.

Westpac Refinance Review | Home Loan Experts

The most common ARM adjustment periods are every 6 months or every 12 months. The frequency of ARM adjustments is established at the time of application and the terms will be outlined in your ARM note. Some of the most common ARM products provide an initial interest rate that will be fixed for 1, 3, 5, 7 or 10 years, and then adjust annually thereafter for the life of the loan. Redraw allows you to withdraw money you've contributed towards your home loan over and above your minimum required repayment.

Your loan may be current, but you may still owe interest for the prior month. In addition, there may be outstanding late fees or other charges on your account, and in most counties there is a fee for recording the lien release. Other amounts you may be charged as part of your payoff total include mortgage insurance premiums and or amounts needed to cover a negative balance in your escrow account.

Redraw

Partial Offset Account Did you know you can get a partial offset account with fixed-rate loans? Rate Tracker Home Loan A rate tracker home loan is linked directly to your interest rate so it moves depending on the RBA cash rate. Split Mortgage Can't decide whether you should lock in your fix your interest rate or go variable? Variable Rate Home Loan Are you looking for a flexible mortgage? Find out how much you can borrow and if you qualify for a competitive variable rate home loan.

NAB’s Choice Package is their most popular home loan product if you're borrowing more than $250,000. Borrowers can gain extra benefits such as discounted premiums on selected insurance products and discounts on margin loan interest rates. National Australia Bank is one of the big four Australian banks and specialises in financial solutions from home loans to online banking. Using your redraw facility can also be cheaper than using acredit cardorpersonal loan. This is because the interest charged on your home loan is usually lower than with other types of credit.

Any additional repayments you make goes towards your ‘available redraw’ which can be drawn down when required. Simply login to online banking to activate and submit your request and you’ll be ready to redraw on your home loan when you need to without the need to complete any paper forms. The payoff of your loan can be delayed for any number of reasons. If you continue to make your scheduled monthly payments, you will protect your credit from being adversely affected by a late payment even if your payoff is delayed. Property taxes, also known as real estate taxes, are assessed on your property by your local government (e.g. city, county, village or township) for the various services provided to you. When you pay property taxes each year, you're paying for necessities such as police and fire department services, garbage pickup and snow removal.

Bridging Loans Bridging finance can allow you to buy and move into your new property without having to sell your existing home first but is it the right option for you? Equity Loans Looking to refinance, renovate, invest on a property or purchase a new home? Find out which lender can get you a loan approval with the cheapest rates!

Once you log into our website, click on the drop down box located on the top right-hand side of the Home Page. Once you are logged into our website, you can click on My Loan/Manage Loan Information and then click the EDIT button. On that screen you can update your mailing address, email or phone numbers online. Yes, Simply log into your account, click on Account Management and then select Document Center. You can select Mail under Delivery Preferences, agree to the terms and conditions and click Let's do this! To stop receiving your statements electronically and start receiving your statements in the mail.

NAB’s fixed rate home loan has similar extra features to the variable rate loan, when bundled with a NAB Choice Package. With effect from 21 October 2022, the offer is only available to customers one time per six months from the date of initial drawdown of an eligible loan until the offer is withdrawn. If a customer refinances more than one loan at the same time, they will only receive the Cash Bonus once. The available redraw on your home loan may reduce so that by the end of your agreed loan term, both your loan balance and the available redraw will be zero. Adjustments to your available redraw will occur on your monthly repayment date to help manage this.

Also, as your loan amortizes and the principal balance reduces, the amount of interest you pay each year may decrease. The terms of your loan agreement require evidence of continuous adequate insurance coverage. Therefore, we must have proof of your insurance coverage or we may have to obtain a lender-placed insurance policy on your property at your expense. More information on adequate insurance coverage and the kind of documentation that you must provide can be found in down load below. Different Adjustable Rate Mortgages (ARM’s) have different adjustment periods. There are ARM’s with an initial interest rate that will be fixed for the first 5, 7, or 10 years.

On average, NAB takes 1-3 working days to get back to you once you submit a loan application. The refinancing process can take longer, depending on the complexity of your situation. Along with other big banks, NAB passed on interest rate cuts to their customers when the RBA revised rates downwards in March and November 2020. A variation of an existing NAB Home Loan with no new lending over $250,000 which results in a new account number does not qualify as an eligible refinance for the purposes of the Cash Bonus. If you chose to make Interest Only payments, amortisation of redraw will not occur for the length of the Interest Only term. If you’re currently using a redraw facility to deposit money that you plan on using later, an Everyday Offset may be more suitable if you plan on using the money more regularly.

No comments:

Post a Comment